Apollo Hill Overview

The Apollo Hill Project is situated in the heart of the world-class Eastern Goldfields district in Western Australia.

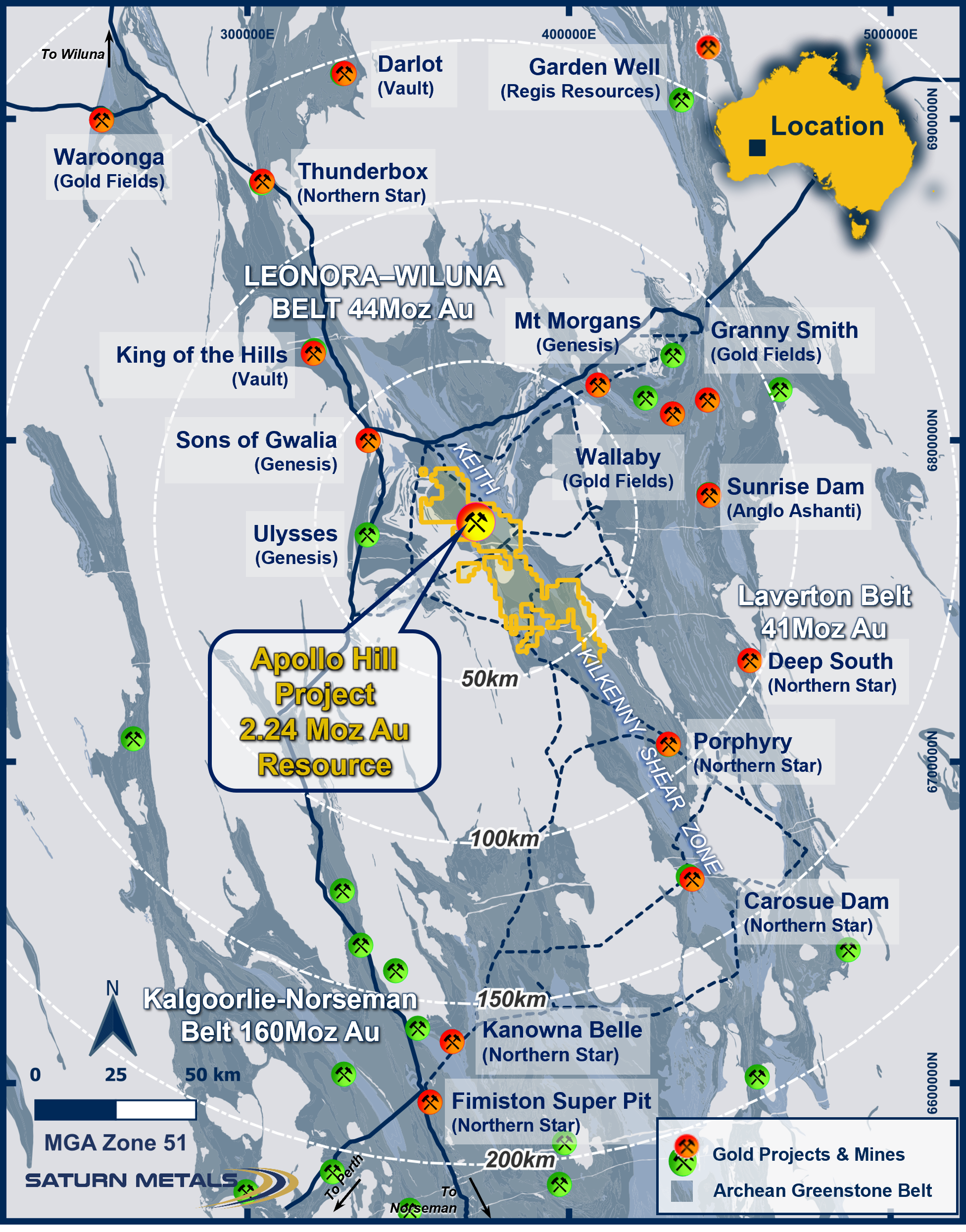

Apollo Hill Project Location

The Project is located approximately 650 km NE of Perth and approximately 50 km SE of the gold mining and processing town of Leonora.

Access to the Project is via the bituminised Goldfields Highway heading northeast from Kalgoorlie. The Project is readily accessible by way of a network of dirt roads, station roads and historical mining tracks.

Several multi-million-ounce gold deposits are known in the district.

Eastern Goldfields Gold Endowment

The Apollo Hill Project comprises 27 highly prospective gold exploration and mining licenses (approximately 967.59 km² of ground), in addition to 66 miscellaneous licenses for water /or infrastructure purposes (approximately 931.74km²).

The Project’s major asset is the Apollo Hill (July 2025) JORC Compliant Measured, Indicated and Inferred Mineral Resource of 137.1 Mt @ 0.51 g/t Au for 2,239,000 ounces of gold using a cut-off grade of 0.2 g/t Au reported within a constraining pit shell.

The Apollo Hill tenements are close to excellent infrastructure and form contiguous tenure.

Apollo Hill Resource

Strategic Sized Asset

The Apollo Hill gold deposit is the cornerstone of Saturn’s Apollo Hill portfolio.

The Measured, Indicated & Inferred Apollo Hill Mineral Resource was recently upgraded to 118.7Mt @ 0.53 g/t Au for 2,030,000 ounces of gold reported above a cut-off grade of 0.20 g/t Au within an optimised pit shell developed using a A$3,300/oz (US$2,069) gold price and assuming low-cost bulk tonnage mining and heap leach processing. This represents:

- The addition of 190,000 oz to the previous 1.84 Moz Mineral Resource (June 2023); and

- The combined higher confidence Measured and Indicated Mineral Resource categories expanding to 1.15 Moz.

This robust Mineral Resource will guide initial mine planning for the Apollo Hill Pre-Feasibility Study.

For further detailed information in respect to the resource, refer to the ASX announcement ‘Apollo Hill Gold Resource Exceeds 2Moz (12 February 2025), which includes the relevant JORC compliance Table 1.

Oblique view 3D Representations of the February 2025 Apollo Hill Mineral Resource model and selected nominal constraining pit for reporting, with topography.

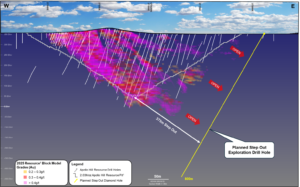

Oblique block model cross-section (South West – North East, A-A1 on Figure 1 3D diagram) ± 30 m showing gold grade and block locations.

February 2025 Apollo Hill Mineral Resource

Growth Plans

The Company has always pursued resource growth with increasingly aggressive drilling campaigns to drive the next step change of the Apollo Hill project and asset base.

Organic investment at the drill bit is leading to a step change in opportunity in a rising gold environment.

Our biggest drill program to date, in 2025, will lead to a further update of the Mineral Resource, including a focus on categorisation improvement, which will provide a basis for our maiden Ore Reserve, as we finalise our Apollo Hill Pre-Feasibility study towards the end of 2025.

Recent Excellent Results at Apollo Hill

- 45m @ 1.04g/t Au from 190m within 89m @ 0.74g/t Au from 146m – AHRC1010

- 53m @ 1.08g/t Au from 128m including 16m @ 3.02g/t Au from 144m – AHRC1022

- 20m @ 2.04g/t Au from 3m within 65m @ 0.77g/t Au from 3m – AHRC1049

Clear Step Out Exploration Potential

- Further economies of scale if successful

Oblique block model cross-section (South West – North East, ± 30 m showing gold grade and block locations, with conceptual step out drill hole.

Apollo Hill Development

- Simple metallurgy – Apollo’s biggest cost differentiator.

- Preliminary economic assessment studies underway.

- Pilot plant design concept 1 Mt @ 0.6 g/t Au for 19.5 koz mined and 14 koz recovered, strip ratio <0.85:1.

Scalability

- Low 2s strip ratio, more ounces in shell.

- Thick ore zones +100 m.

- Bulk tonnage.

- Bigger selective mining units, economies of scale and lower operating cost.

- Expanded pit shell to 250 m – modest depth by current standards.

- ‘Base load’ ounces.

- Targeting big, efficient equipment.

Metallurgy

- Efficient, low-cost recovery route.

- Excellent recovery – +74%–85% in columns.

- Flat grade recovery curve – +77% at 0.2 g/t Au, allows low cut off grades.

- Rapid leach times >80% in 21 days.

- Coarse crush – 8 mm, low energy use.

- Simple fresh rock, free gold in quartz mineralogy.

- Rock – strong percolation 14,000 l/m²/hr.

- Excellent cyanidation ~1 kg/t consumed.

- Low agglomeration – only 3 kg/t cement required.

- High pressure grinding roll (HPGR) efficiency.

- Conventional mill and CIL optionality: excellent recovery at coarse grind sizes with high gravity gold content – 91.8% achieved at 250 µm P80 grind – with 56% by gravity.

Preliminary Economic Studies Underway

- Initially targeting 10 Mtpa for 8 years from current resource.

- +100 koz per annum recovered in low-cost production scenario.

- Preliminary site layout being considered.

- Preliminary plant costings and operating cost assessment underway.

Apollo Hill Camp Scale Opportunity

Greenfield Target Areas

- ~1,000 km² of greenfields land package (60 km long position in the greenstone belt);

- 16 Prospects discovered to date;

- Large tracts of ground package untested;

- Regional drilling planned.